The Chinese authorities have cut interest rates for the time since the Global Financial Crisis (GFC). One year lending and deposit rates were cut by 0.25%.

Lending rate – 6.31%

Deposit rate – 3.25%

Although this should encourage spending with an increase in the money velocity in the circular flow some commentators are concerned that the Chinese authorities know something about their economy that the rest of world is in the dark about.

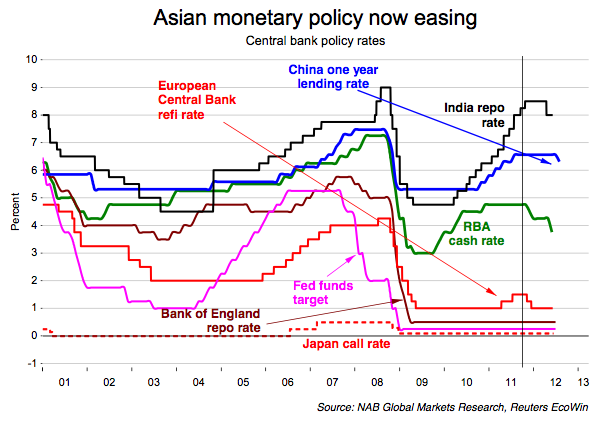

It is interesting to see the reaction of main central banks in the aftermath of the GFC and how aggressive they were in cutting rates – US, EU, UK – relative to the other countries on the graph, namely China, India and Australia. Furthermore notice that some economies seem to have been at a different part of the economic cycle namely Australia, India, and the EU as their central bank rates have risen in order to slow the economy down. This is especially in India as they have had strong contractionary measures in place but have now started to ease off on the cost of borrowing.

Indian growth has slowed to 5.3% this year and although this seems very healthy it is the lowest level in 7 years. A developing nation like this needs higher levels of growth to create the jobs for their vast working age population and without employment there could be a situation not unliike that of Spain where over 50% of those under 25 don’t have a job. The main cause of the slowdown seems to be from a lack of private investment.

Also look how low rates are in the US, UK, and EU. With little growth in these economies the policy instrument of lower interest rates has been ineffective and they are in a liquidity trap. Increases or decreases in the supply of money do not affect interest rates, as all wealth-holders believe interest rates have reached the floor. All increases in money supply are simply taken up in idle balances. Since interest rates do not alter, the level of expenditure in the economy is not affected. Hence, monetary policy in this situation is ineffective.

If you have 3% deposit rate and 6% lending rate and 6% inflation rate savings are effectively earning -6%. This is how money is transferred from the poor to the rich. In the case of Chain this means the bloated SOE’s and regional governments who borrow cast quantities at rates lower than 3%.

http://brontecapital.blogspot.co.nz/2012/06/macroeconomics-of-chinese-kleptocracy.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+BronteCapital+%28Bronte+Capital%29

Prices go up but wages don’t. This is a huge global phenomena and it results in the transfer of wealth from those who have no means to recoup costs and who have reduced access to capital i.e. the poor to those who do, the rich.

I believe this situation is starting to happen with much greater significant in New Zealand. Food and energy prices are way up but wages are not. Savings return nothing after tax and if inflation for poor people, i.e. those who spend the greatest amount on food and energy, was counted correctly it would likely be significantly higher than it is being seen as now.

At any rate it is worth noting the inflation readings are retrospective. They tell you what has happened and any adjustments are likely to be slow. Accordingly those for whom any adjustment arrives late have already spent considerable time going backwards. Relatively speaking other have spent considerable time going forwards. Hence the gap between rich and poor just gets bigger and bigger over time.

LikeLike

The negative deposit rate above should be -3% not -6%. Of course those borrowing at 6% in an environment of 6% inflation are effectively getting their money for free. This is one reason why for the NZ government it makes sense to refinance and borrow more rather than less at the moment.

LikeLike